Union County Schools breakfast

The day after the Mississippi Legislature changed the names of the state’s junior colleges to community colleges in 1987, Itawamba Community C…

Micah Allen Reed of New Albany has been selected for the Mississippi Delta Community College Student Hall of Fame.

Saturday, April 14, as of 3 p.m. NALG&W had restored an outage area reported earlier that afternoon.

Mississippi Representative Jason White will be the speaker for Itawamba Community College’s 10 a.m. commencement ceremony, May 10, at the Davi…

Each year, New Albany Middle School teacher Parks Smith challenges students to learn Henry Wadsworth’s poem, “Paul Revere’s Ride.” This year, …

Sarah Frances Hardy will be the guest storyteller May 15 for Preschool Storytime at 10 a.m. to read her new book, One Mississippi. One Missis…

Currently in New Albany

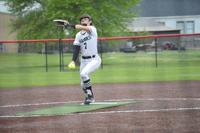

BASEBALL AND SOFTBALL PLAYOFF CAPSULES

WINONA - East Union landed solidly into second place at Thursday's 1-2A track and field super regionals at Winona.

Different coach, different approach, but the same result for New Albany tennis: another state championship.

VICKSBURG - The New Albany Bulldogs are still top dog in Class 4A tennis as they successfully defended their title with a 6-1 win over West La…

IUKA - Courtland Earl had a huge day at the 1-4A super regional at Tishomingo County as he won both hurdle events and placed second in the tri…

West Union came in second in both boys and girls track and field at the Region 4-1A meet. Vardaman was first in both. The boys and girls each …

MYRTLE - The Myrtle Lady Hawks defeated the Lady Wildcats from Houlka in game one of the first round of the 1A softball playoffs Friday night …

Watchdog & Storytelling

April is Child Abuse Prevention Month. Unfortunately for many children, their abuse goes unnoticed, unseen, or hidden from the public eye. Som…

Co-chairs Billye Jean Stroud and Chris Pugh pulled it off, again.

It’s 8:05 a.m. Monday as I write this, and eclipse hysteria is nearing its zenith (if I may toss in an astronomical term to try to sound more …

We were very lucky March 15.

On behalf of the BNA Bank board of directors, James R. Collins, Chief Executive Officer, announces the following promotions:

The Mississippi Small Business Development Center at the University of Mississippi is supporting small-business owners and budding entrepreneu…

The Union County Development Association is trying to connect companies needing workers with those who are seeking employment through a job fa…

Physicians and staff of the Children’s Clinic will host a drive-through event from 4-6 p.m. Thursday, Sept. 2, to show off their n…

New Albany Building Inspector and Code Enforcement Officer Eric Thomas has been elected president of the Northeast Chapter of the Building Of…

NEW ALBANY • Herman Windham, owner of Windham TV and Appliance in New Albany, said his business is a great place to buy all types of appliance…

NEW ALBANY • Brenda Smith, owner of Redesigning Women in downtown New Albany, said the work ethic she learned growing up on a farm in Union Co…